According to the building services industry economic review, the long-awaited turnaround for the better is on the horizon. In renovation construction, residential renovations are growing, but, for example, renovations of public spaces are still stagnating. The market situation in the industry is very fragmented and in many places the economic situation continues to be gloomy.

The balance figures for new construction are still negative. However, in growth areas the outlook has turned slightly more positive, especially in industrial construction and the construction of public spaces. The outlook for housing production is still sticky, but the balance figure for the largest operators is positive, meaning production is expected to increase slightly. Outside growth areas, the situation is still quite difficult, especially for smaller companies.

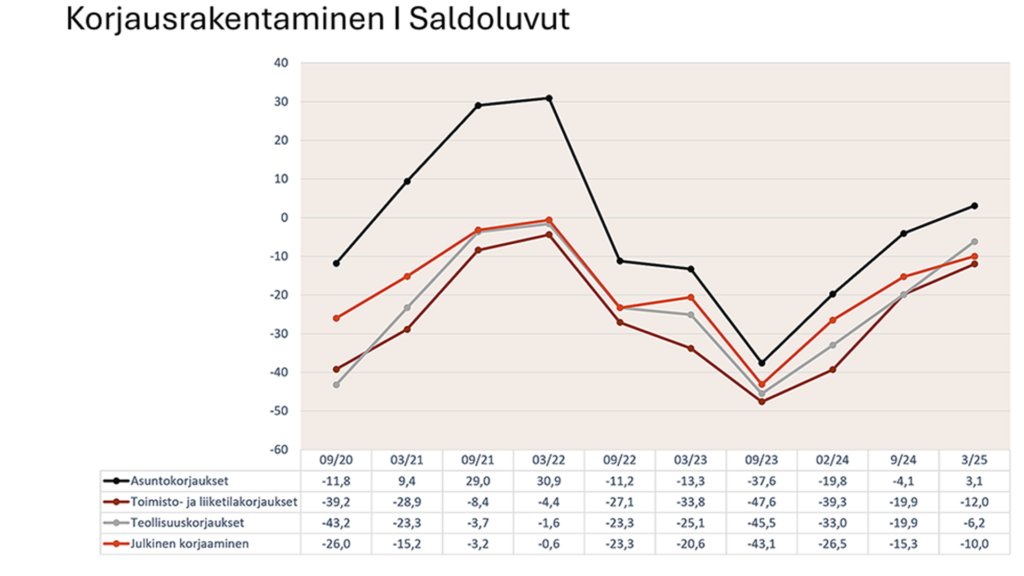

Housing renovations on the rise, the situation in municipalities is worrying

The balance figure for residential renovations has turned positive for the first time in three years. The situation for industrial renovations has also improved since autumn 2024. Measured by turnover, the largest operators have the most positive expectations for residential and industrial renovations.

"The situation with the repair of public spaces is worrying. Along with other built environments, real estate is the municipality's largest asset, and for example, the renewal of building technical systems has been neglected. This forgets the importance of maintaining the value of properties and, on the other hand, continuously reducing operating costs," CEO of the Electrical and Telecommunications Contractors' Association STUL and the Building Technology Association Marko Utriainen says.

“Delaying project decisions has a negative impact on the vitality and attractiveness of a municipality. It is high time for municipal decision-makers to start renovation projects. The energy efficiency directive that will be implemented next year will also set requirements for municipal properties; preparations should start immediately,” said the CEO of the Finnish Association of Building and Heating Engineers (LVI-TU) and the Deputy CEO of the Finnish Building and Heating Engineers Association (Talotekniikliitto). Mika Hokkanen toteaa.

Requests for quotations are increasing

The number of requests for tenders has increased since last autumn, the balance figure is now slightly negative (autumn 2024 -34,1 and spring 2025 -8,9). The regional outlook varies considerably: the most positive situation is in Lapland, South Karelia, Central Ostrobothnia and national operators.

Requests for quotations have decreased among small operators, while the largest increase is among larger operators. Looking at size categories, for smaller companies, approximately one in five quotations resulted in a deal, while for larger companies the ratio was one in ten.

“The responses reflect the downward trend in the construction industry. The long-awaited turnaround is happening slowly. Although the balance figures – excluding housing renovations – are still in the red, they are clearly better than last autumn. This reflects the situation in the construction industry and the Finnish economy. There is a glimmer of light at the end of the pipe, but the ship seems to be turning relatively slowly. What is needed now is a boost that would turn people’s and companies’ confidence in the future and their own economy into a more positive one”, Chairman of the Board of the Finnish Building Technology Association, CEO of Maskun Building Technology Team Oy Mika Nikula toteaa.

Measured in terms of the balance figure, the order backlog has decreased over the past six months, but the decrease is expected to slow down towards the autumn. The largest operators have the most positive outlook. The median order backlog for full employment is four months for designers and three months for contractors. Just under four percent of the industry's personnel are currently laid off.

“The positive news for electrical engineering is the development of the order book from autumn 2024 to spring 2025. During the six months, 43% of the order book has grown and a third has remained unchanged. A clear pick-up is expected towards autumn, with 95% estimating that the order book will remain unchanged or increase. Electrical engineering is being driven to budding growth by energy efficiency projects, industrial properties, renovation of public spaces and new construction. Regional differences are large and even a single project can sway the statistics. Recruiting skilled personnel is a challenge in the design department,” Managing Director of Electrical Engineers NSS Jouni Kekalainen says.

Market situation freezes profitability

Increased competition is eating into the profitability of companies in the sector. Almost half estimate that it will remain unchanged, while only 12% expect growth. With the exception of larger companies, all respondent categories by turnover expect the situation to deteriorate as measured by balance figures.

Almost every second respondent estimates that their turnover will continue to decline this year, but the situation has improved slightly since the autumn. More than half of the largest operators expect their turnover to increase, with the weakest expectations being among companies with turnover below 1,1 million euros.

“The building services industry has great prospects. We are needed in implementing the green transition, mitigating climate change, and preserving the value of the built environment. Despite the economic downturn, most people feel that the availability of skilled labor is weak or moderate. If the situation is like this now, how will the availability of skilled labor be when the boom season begins?” Mika Nikula reminds us.

More information about the building services industry business survey From the LVI-TU website